National Insurance changes in July. How will it affect you?

From 6 July 2022, the threshold at which workers start paying National Insurance will increase by £3,000. It means less of workers’ income will be subject to National Insurance as they will earn up to £12,570 a year before they pay it. A sharp increase from the current rate of £9,880.

Almost 30 million workers will benefit, including 2.2 million people who will be taken out of paying National Insurance altogether.

We explain what the changes mean for you and how it compares to what you will pay in National Insurance from July.

HOW MUCH NATIONAL INSURANCE WILL I PAY?

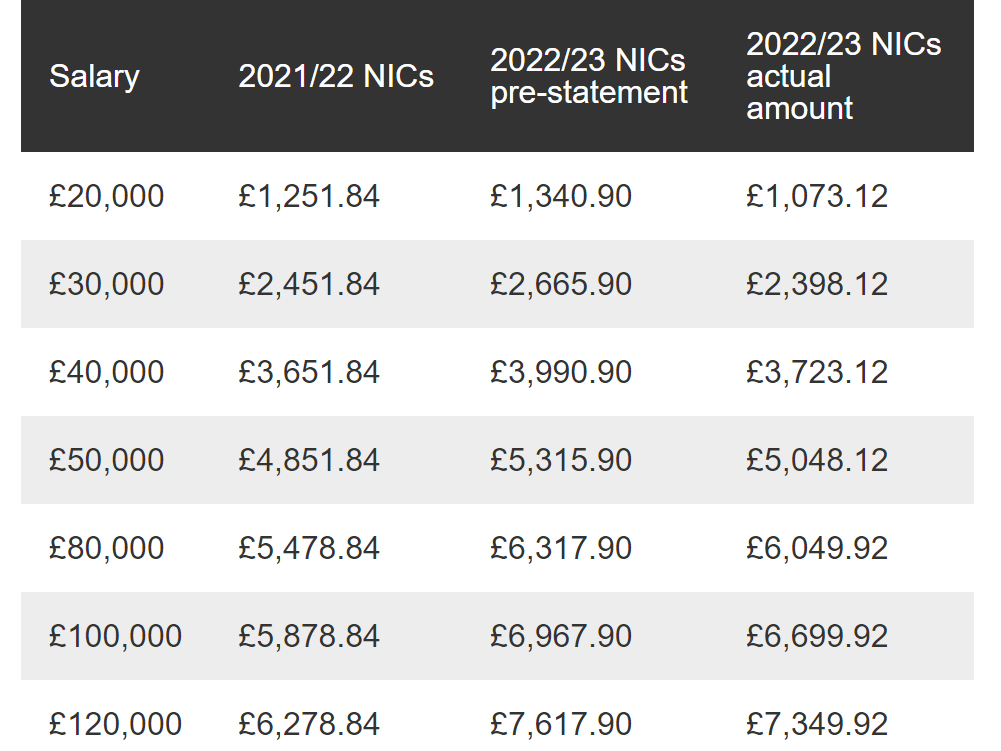

People with a salary below £34,372 will see the most benefit from the change, with the rate rise effectively cancelled out.

For these people, the threshold rise in July is worth more than April’s increased rate in national insurance.

If you earn £20,000 a year you pay £111.74 a month in National Insurance. From July, when the threshold rises, you will pay £82.04 a month.

If you earn £30,000 a year you pay £222.15 a month in National Insurance. From July, when the threshold rises, you will pay £192.46 a month.

If you earn £40,000 a year you pay £332.58 a month in National Insurance. From July, when the threshold rises, you will pay £302.87 a month.

The threshold increase will mean a saving for some workers compared to what they paid after the April 2022 rise, although as you will see in the table below, it means some will pay less NICs than they do now.

While the lower NI threshold will rise to £12,570 in July, the upper earnings limit will remain at £50,270 for the 2022-23 tax year. So, technically all employees, regardless of income, will benefit from the lower threshold being increased.

NATIONAL INSURANCE CHANGES IF I’M SELF-EMPLOYED?

Self-employed workers pay National Insurance at a different rate to employees, but they won’t benefit from the NI threshold rising to match the income tax personal allowance.

Currently, self-employed people with profits over £6,515 a year pay a flat rate NI of £3.05 a week. These are known as class 2 contributions.

In addition to class 2, any profits above the lower profits limit of £9,568 are also subject to 9% NI, while profits over £50,270 are subject to a further 2% (these are called class 4 contributions).

Now the flat-rate class 2 contributions have been scrapped. The 9% contribution over the lower profits limit will increase by 1.25 percentage points to 10.25%. For profits over £50,270, the NI rate will increase to 3.25%

However, the small profits threshold and lower profits limit are also being raised from July 2022. The small profits threshold will increase to £6,725 and the lower profits limit will rise to £11,908. Those with profits between the small profits threshold and lower profits limit won’t pay any National Insurance – but they will still build up NI credits.